Charitable Giving

Most people will tell you that when it comes to charitable giving they do not allow tax deductions to get in the way. But the truth is, it does.

Charitable giving by individuals declined in 2018 for the first time since 2013. This is partly due to the tax reform that increased the standard deduction to $24,000. Even religious institutions saw a decline in tithing in 2018. We cannot for sure say that is all from the tax reform, but it likely does play a part in it. When you decide to itemize your deductions, charitable contributions is an item to that list of deductions.

You can also ask your tax professional how much more you can give to lower your taxes for the year. Sometimes those tax professionals stick their nose in the air and say that you should give what you feel is right and sometimes they do their job and tell you a number. If you want to figure out this number for yourself you just need to add up all your itemized items, such as mortgage interest, property taxes, medical and dental charges that exceed 7.5% of your gross income, contributions, etc and take that total and subtract from your standard deduction and you will want to exceed that number to itemize, so you would contribute more to charities.

For example, let's say you are married filing jointly and for 2019, that would make your standard deduction at $24,400. You have the below items so far in your itemized deductions:

Mortgage interest $10,000

Property Taxes $3,000

Charitable Donations/Tithing: $10,000

Total of items: $23,000

Difference between your itemized list and standard deduction: $1,400

You would need to donate the difference and more if you choose in order to itemize. This allows you to deduct even more from your tax liability. Keep in mind that there are limitations to this.

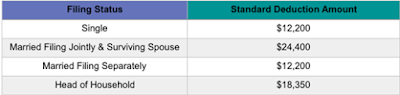

The IRS increased the standard deduction again for the 2019 year to account for inflation, see picture above. It will be interesting to see what those numbers look like for 2019. Will we continue to see a flat line or decline in giving or will it start to increase again? Hopefully, charitable contributions will increase but it looks like we won't see those reports until this summer.

One way to take advantage of your donations is instead of donating $5,000 a year to x charity, you donate every 2 years $10,000 so you can take advantage of the itemized tax deduction.

You can also give and save on taxes by donating appreciated securities to a charitable organization. Neither you or the organization will have to pay capital gains tax. By donating eligible shares, you are saving on not having to pay the capital gains tax plus you get to deduct the value of the gift on your tax return. Win, Win, Win!

If you are someone who loves to donate outside of your religious institution, there are ways to donate that sometimes multiply your actual donation. You will not see that in your tax deduction but the charity organization that you give to will see the increase there. For example, sometimes businesses, radio stations, etc will match your donation up to an amount. This is usually very big during the holiday season. Sometimes an owner of a business will be effected by a cause and will send out an email saying that company will match all donations to a specific charity.

If you choose to donate your unused household items, be sure to keep a list if you are able to itemize. You can put a price to those donated goods by using Goodwill Value Guide or some other similar source. Be sure to keep your records and to provide to your tax preparer.

Charitable giving by individuals declined in 2018 for the first time since 2013. This is partly due to the tax reform that increased the standard deduction to $24,000. Even religious institutions saw a decline in tithing in 2018. We cannot for sure say that is all from the tax reform, but it likely does play a part in it. When you decide to itemize your deductions, charitable contributions is an item to that list of deductions.

You can also ask your tax professional how much more you can give to lower your taxes for the year. Sometimes those tax professionals stick their nose in the air and say that you should give what you feel is right and sometimes they do their job and tell you a number. If you want to figure out this number for yourself you just need to add up all your itemized items, such as mortgage interest, property taxes, medical and dental charges that exceed 7.5% of your gross income, contributions, etc and take that total and subtract from your standard deduction and you will want to exceed that number to itemize, so you would contribute more to charities.

For example, let's say you are married filing jointly and for 2019, that would make your standard deduction at $24,400. You have the below items so far in your itemized deductions:

Mortgage interest $10,000

Property Taxes $3,000

Charitable Donations/Tithing: $10,000

Total of items: $23,000

Difference between your itemized list and standard deduction: $1,400

You would need to donate the difference and more if you choose in order to itemize. This allows you to deduct even more from your tax liability. Keep in mind that there are limitations to this.

One way to take advantage of your donations is instead of donating $5,000 a year to x charity, you donate every 2 years $10,000 so you can take advantage of the itemized tax deduction.

You can also give and save on taxes by donating appreciated securities to a charitable organization. Neither you or the organization will have to pay capital gains tax. By donating eligible shares, you are saving on not having to pay the capital gains tax plus you get to deduct the value of the gift on your tax return. Win, Win, Win!

If you are someone who loves to donate outside of your religious institution, there are ways to donate that sometimes multiply your actual donation. You will not see that in your tax deduction but the charity organization that you give to will see the increase there. For example, sometimes businesses, radio stations, etc will match your donation up to an amount. This is usually very big during the holiday season. Sometimes an owner of a business will be effected by a cause and will send out an email saying that company will match all donations to a specific charity.

If you choose to donate your unused household items, be sure to keep a list if you are able to itemize. You can put a price to those donated goods by using Goodwill Value Guide or some other similar source. Be sure to keep your records and to provide to your tax preparer.

A couple thoughts...

ReplyDelete- Spot on post! Lumping together donations in one calendar year is a great way to get over the standard deduction hurdle!

- Even if you can't itemize on your Federal return, Colorado allows you to deduct your charitable giving on the Colorado return (to the extent it exceeds $500)

- To really maximize your tax impact, consider giving to qualified Colorado "Child care" programs. In addition to the standard tax deductions, you'll also get a credit (which is infinitely better than a deduction as it reduces your taxes $1 for $1) for up to 50% of your donation.

Thanks, Jimmy! :)

Delete